Tax on taxable income calculator

Use this federal income tax calculator to estimate your federal tax bill and look further at the changes in 2021 to the federal. Your household income location filing status and number of personal exemptions.

Effective Tax Rate Formula Calculator Excel Template

This includes cash and the fair market value of any item you win.

. As a result your taxable rental income will be. Your rental earnings are 18000. Income Tax Calculator - Learn How to Calculate Income Tax Online for FY 2022-23 AY 2023-24 with ICICI Prulifes Income Tax Calculator.

Get better visibility to your tax bracket marginal tax rate average tax rate payroll tax deductions tax refunds or taxes owed in 2022. For example if you fall into the 25 tax bracket a 1000 deduction saves you 250. Find out your federal taxes provincial taxes and your 2021 income tax refund.

The first 12270 will be taxed at 20. Estimate your 2021 Tax Return for free now and include your gambling income or losses. Determine taxable income by deducting any pre-tax contributions to.

Form 1040EZ is generally used by singlemarried taxpayers with taxable income under 100000 no dependents no itemized deductions and certain types of income including wages salaries tips taxable scholarships or fellowship grants and unemployment compensation. 425 of taxable income. Michigan Income Taxes.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. Use our simple 2021 income tax calculator for an idea of what your return will look like this year. Taxable income Tax on this income.

1892 in rental income tax. Calculate net income after taxes. Estimate your personal tax payable for the current assessment year using our free online Singapore Personal Income Tax Calculator.

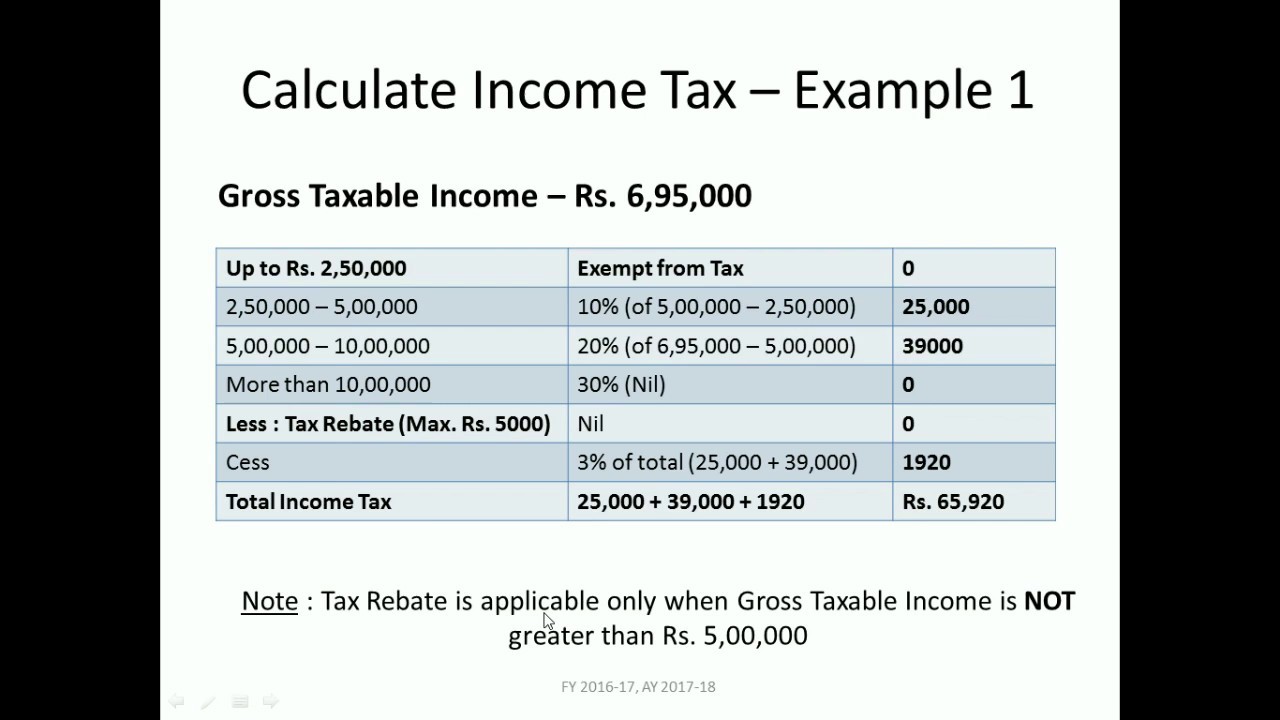

2016-2017 2017-2018 2018-2019 2019-2020 2020-2021 pre. To take an example suppose your taxable income after deductions and exemptions is exactly 100000 in 2012 and your status is Married filing jointly. Estimate Federal Income Tax for 2020 2019 2018 2017 2016 2015 and 2014 from IRS tax rate schedules.

Taxable gross annual income subject to personal rates W-2 unearnedinvestment business income not eligible for 20 exemption amount etc Traditional IRA Contribution Itemized deductions. You can claim 1000 as a tax-free property allowance. Tax Bracket Federal.

See this Tax Calculator for more. That is one of the lowest rates for states with a flat tax. See Social Security Benefits calculation for calculation on line 20b as part of Taxable income.

2022 tax refund calculator with Federal tax medicare and social security tax allowances. Income Tax Department Income and Tax Calculator. 2022 Oklahoma tax brackets and rates for all four OK filing statuses are shown in the table below.

The highest personal income tax rate of 22 are for individuals with an annual taxable income of more. Eligible dividends This is any dividend paid by a by a Canadian corporation to a Canadian resident who is designated to receive one a corporations. Only 50 of realized capital gains are taxable in Canada.

This simple income tax calculator will instantly tell you how much tax you need to pay based on your income for the 202122 financial year. Rental income tax breakdown. This income tax calculator Pakistan helps you to calculate salary monthlyyearly payable income tax according to tax slabs 2022-2023z Income Tax Calculator 2022 23 Monthly Annually.

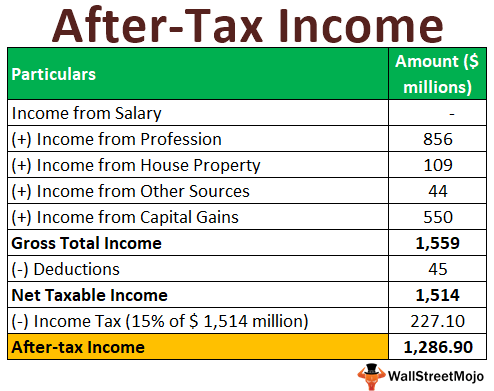

Total tax on above including cess 273000. The net income of an individual is the take-home pay that an employee receives after paying taxes and deductions. Income Tax Calculator - How to calculate Income taxes online.

After salary sacrifice before tax Employment income frequency Other taxable income. If you invest in life. Net Taxable Income Income Liable to Tax at Normal Rate ---Short Term Capital Gains Covered us 111A 15.

Youll get a rough estimate of how much youll get back or what youll owe. Singapore Company Registration Specialists. Find your total tax as a percentage of your taxable income.

Calculate your total tax liability. 0 x 10. 17400 minus.

2022 free Canada income tax calculator to quickly estimate your provincial taxes. Your Expenses in detail F1040 L23-35 Educator expenses Certain business expenses of reservists etc Health. Please enter your income deductions gains dividends and taxes paid to.

The taxable income will be worked out after making applicable deductions if any. Call Us 65 6320 1888. High incomes will pay an extra 38 Net Investment Income Tax as part of the new healthcare law and be subject to limited deductions and phased-out exemptions not shown here in addition to paying a new 396 tax rate and 20 capital gains rate.

For individuals whose total taxable income is above Rs5 lakh the tax rate discussed earlier would apply. 2454 in rental income tax. Tax Changes for 2013 - 2022.

Just answer a few simple questions about your life income and expenses and our free tax calculator will give you an idea if you should expect a refund and how much or if youll owe the IRS when you file taxes in 2021. Canada income tax calculator. Michigan has a flat income tax system which means that income earners of all levels pay the same rate.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Net taxable income Gross taxable income net taxable income. Other taxable income frequency Annually Monthly Fortnightly Weekly Financial year.

Income Tax Calculator Wondering how to estimate your 2021 tax refund. In Michigan adjusted gross income which is gross income minus certain deductions is based on federal adjusted gross income. Then your tax would be calculated like this.

Oklahoma state income tax rate table for the 2022 - 2023 filing season has six income tax brackets with OK tax rates of 025 075 175 275 375 and 475. 0 18200. To calculate your BC net income follow the step-by-step guide outlined below.

Your taxable income puts you in the following brackets. The Income Tax Department NEVER asks for your PIN numbers. Calculation of gross taxable income in India New regime Nature Amount Total.

Gambling income is almost always taxable income which is reported on your tax return as Other Income on Schedule 1 - eFileIT. Depending on the tax slab and whether you have opted for the old tax regime or the new tax regime. For FY 2020-21 AY 2021-22 2021-2022 2020-21 with ClearTax Income Tax Calculator.

If your total taxable income is less than Rs. Deductions lower your taxable income by the percentage of your highest federal income tax bracket. 5 lakh you will get a rebate of Rs12500 under section 87A.

The next 4730 will be taxed at 40. Yearly Federal Tax Calculator 202223.

Income Tax Formula Excel University

Income Tax Formula Excel University

Excel Formula Income Tax Bracket Calculation Exceljet

Income Calculator With Taxes Store 58 Off Www Wtashows Com

Taxable Income Formula Examples How To Calculate Taxable Income

Income Calculator With Taxes Hot Sale 60 Off Www Wtashows Com

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

How To Calculate Income Tax On Salary With Payslip Example Income Tax Excel Calculator Youtube

Income Calculator With Taxes Online 51 Off Www Wtashows Com

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Taxable Income Formula Examples How To Calculate Taxable Income

Income Calculator With Taxes Online 51 Off Www Wtashows Com

How To Create An Income Tax Calculator In Excel Youtube

Calculation Of Personal Income Tax Liability Download Scientific Diagram

How To Calculate Income Tax Fy 2020 21 Examples New Income Tax Calculation Fy 2020 21 Youtube

Taxable Income Formula Examples How To Calculate Taxable Income

Income Calculator With Taxes Online 51 Off Www Wtashows Com